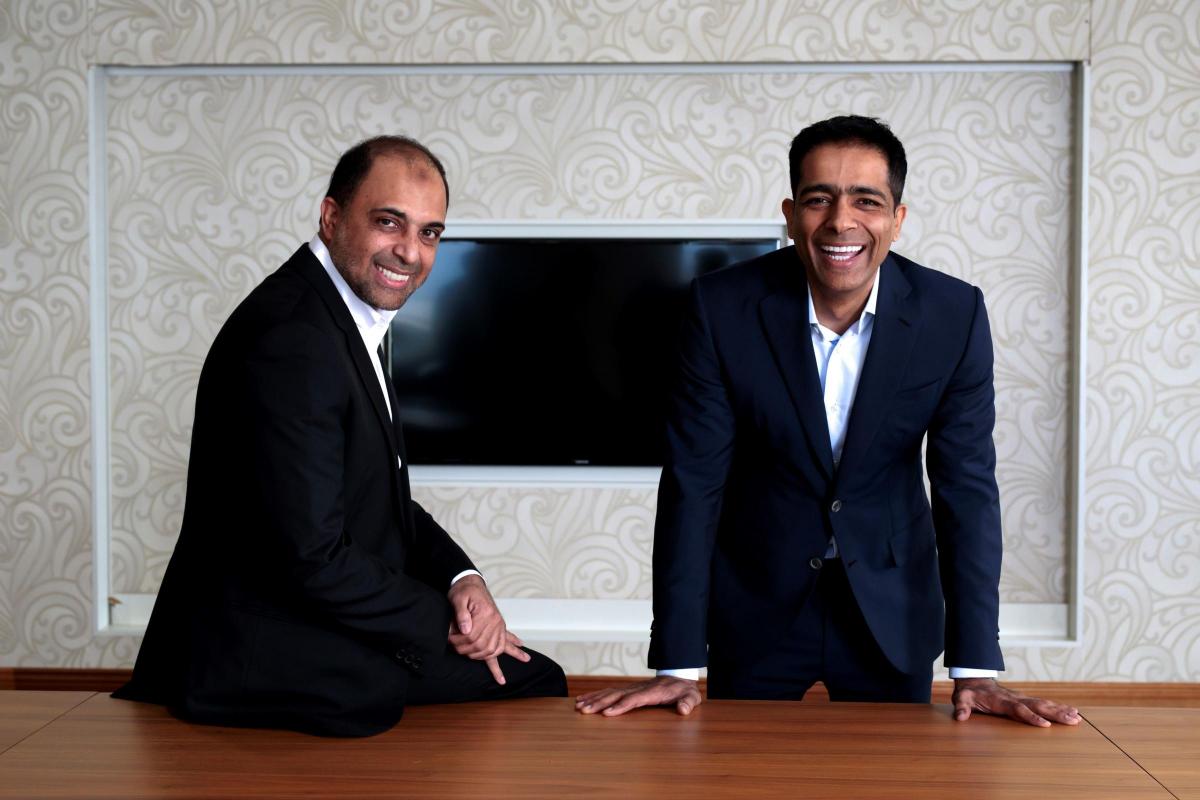

THE Issa brothers' proposal to sell some of their forecourts in order to complete their takeover of Asda has been deemed 'acceptable.'

This comes following the Competition and Markets Authority's announcement last month it was concerned that the Blackburn-born entrepreneurs £6.8 billion takeover of the supermarket chain could lead to higher petrol prices due to a lack of competition in the industry

However, the CMA has today announced that it believes the brothers' proposal to sell some of their sites to 'suitable buyers', thus ensuring that a reasonable level of competition will survive in the market and prices are kept low, would be an acceptable solution to this problem.

In a statement, Mohsin and Zuber Issa along with their partners TDR Capital said: “Over the course of the past 10 days, we have been working constructively with the CMA to offer remedies to address the CMA's competition concerns.

"Today, we are pleased to confirm that the CMA has indicated it has reasonable grounds to believe the proposed remedies are acceptable, enabling us to arrive at a conclusive outcome for the acquisition of Asda in phase 1."

Industry sources had claimed that the brothers had indicated they were willing to sell some of the forecourts late last month with one such source telling trade magazine The Grocer it “would not be the end of the world” for the brothers if they were forced to sell off some of their sites.

The regulator will now examine the proposals in more detail, however the Issa brothers have said that they are confident their proposals will be granted final approval.

Their statement said: “As is usual in cases such as these, the CMA now has a period of 40 days to work through the detail of the proposed divestitures and therefore we are restricted in the level of information we are able to provide on specific sites.

"However, we have been comforted by the significant interest we have already received from potential buyers during this process, demonstrating the strong growth potential of our forecourts and the liquidity in the market.

"Over the coming months, we are confident that we will be able to agree a sale to suitable operators to take over all identified sites, and we will share more information in due course.”

Comments: Our rules

We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. The ability to comment on our stories is a privilege, not a right, however, and that privilege may be withdrawn if it is abused or misused.

Please report any comments that break our rules.

Read the rules hereLast Updated:

Report this comment Cancel