BLACKBURN’S billionaire Issa Brothers have raised a record £2.75 billion’s worth of junk bond sales to fund their latest move to secure ownership of Asda.

This comes after reports that EG Group, which the brothers founded with a single petrol station in Bury in 2001, had borrowed £3.5 billion to complete the deal.

By raising money through selling the bonds, the brothers hope to finance their £6.8 billion purchase of Asda while only injecting a relatively small amount of their own funds, however they have also said that they plan to invest a total of £1 billion in their new business over the coming years.

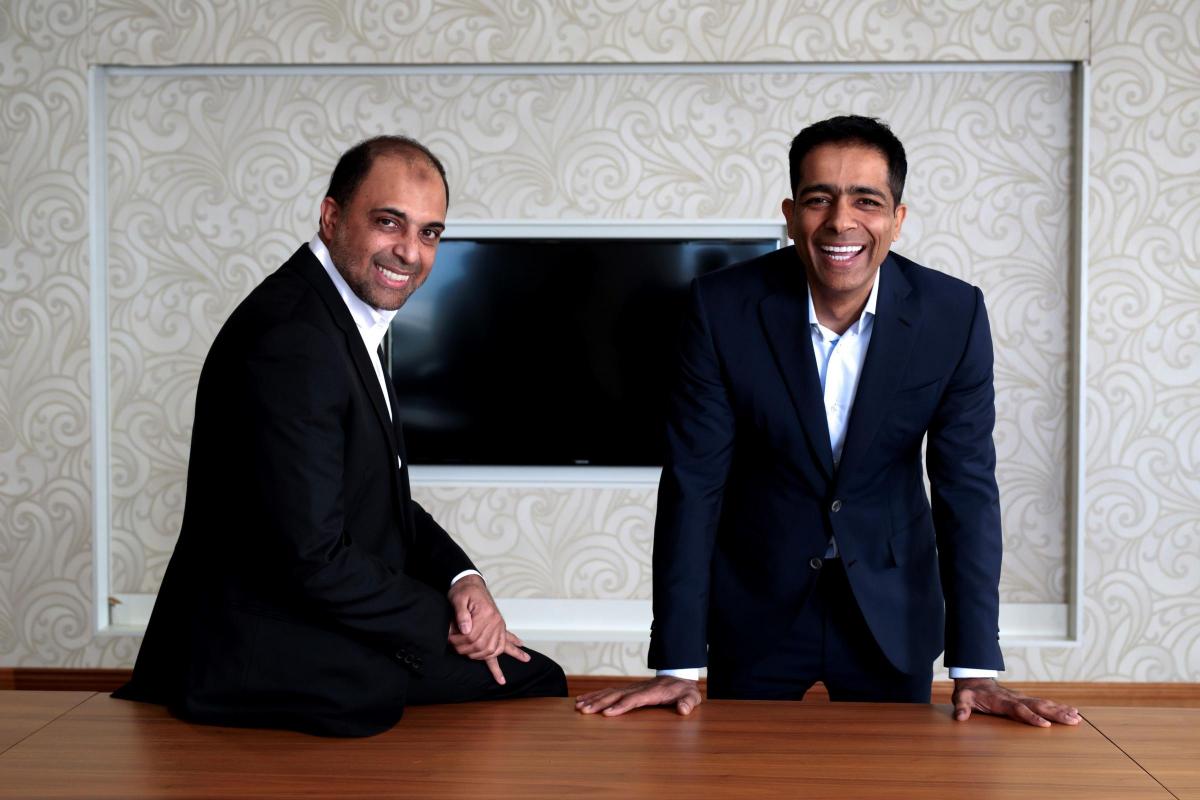

In a joint statement, Mohsin and Zuber Issa said: “Looking ahead, and subject to the required regulatory approvals, we look forward to working with our Asda colleagues to build an even stronger, more differentiated retailer, including through the investment of more than £1 billion in the next three years to further strengthen the business and its supply chain.

“We are also excited about the proposed integration of the Asda forecourts into EG’s established UK operations, which we believe would underpin the future growth of the combined network.”

Bonds are fixed-income debts that corporations and governments issue to investors to raise capital.

When investors buy bonds, they are effectively loaning money to the seller who promises to repay the money on a specific date called the maturity date.

Junk bonds, also known as high yield bonds, are judged to be particularly risky of default and therefore pay out greater amounts of money to investors make this risk worth taking.

EG Group has sold the bonds alongside partners TDR Capital, which proved popular with investors due to Asda’s low debt levels and the £9 billion worth of property involved in the deal.

The Issa Brothers have said that they now expect the deal to be complete by late February, subject to approval by the Competition and Markets Authority.

An EG Group source has also said that further details will be released on the Brothers' plans for the company once approval is granted and the deal is finalised.

Comments: Our rules

We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. The ability to comment on our stories is a privilege, not a right, however, and that privilege may be withdrawn if it is abused or misused.

Please report any comments that break our rules.

Read the rules hereLast Updated:

Report this comment Cancel